Interest Rate Risk in the Banking Book

Overview

Interest Rate Risk in the Banking Book (IRRBB) relates to both present and future risks to a bank’s capital and earnings arising from fluctuations in market interest rates.[1]

In recent years, IRRBB has become an area of increased focus for regulators: this has coincided with significant changes in the interest rate environment across major economies, the ending of an extended period of near-zero rates, high inflation, and industry events such as the failure of Silicon Valley Bank. Developments remain ongoing, and banks can expect further advances in the future.[2]

IRRBB can be sub-divided into components, which include:

Gap risk – arising from mismatches in the re-pricing schedules of assets and liabilities.

Optionality risk – arising from optionality embedded in contracts and from certain derivatives.

Basis risk – arising from assets and liabilities being repriced against differing benchmarks.

[1] Basel Committee on Banking Supervision: Standards - Interest rate risk in the banking book, para. 8.

[2] E.g., in December 2023, the Basel Committee on Banking Supervision published a Consultative Document on the recalibration of shocks for IRRBB: if adopted by the PRA, these new values would replace the interest rate shifts used as inputs to defining shocked interest rates (as shown in Appendix B of the downloadable version).

Regulatory Framework

Effective 1 January 2022, the PRA implemented new requirements and expectations for banks – based on Standards published by the Basel Committee on Banking Supervision (BCBS) – including creation of a regulatory limit for IRRBB and implementation of a Standardised Framework (SF) that banks may elect to follow. These are set out in:

the ICAA Part of the PRA Rulebook (ICAA Rules); and,

(collectively, UK IRRBB Rules).

Key Challenges and Actions

At a high level, the key actions banks should undertake in respect of IRRBB are as follows:

1) Define an appropriate risk appetite based on the materiality of IRRBB to the bank, its risk strategy and its core business activities.

2) Enhance the risk management framework for IRRBB covering all material aspects including governance, risk appetite, roles and responsibilities, measurement, monitoring, reporting, and assumptions.

3) Embed systems, processes, and controls to identify, evaluate, and manage IRRBB.

4) Incorporate critical IRRBB aspects into other documents, e.g., Treasury Policy.

5) Carry out Pillar 2 assessments of IRRBB via the ICAAP.

6) Manage IRRBB in line with the IRRBB framework and monitor and understand it on an ongoing basis.

7) Evaluate the relevance of IRRBB disclosures.

Considering these key action items, and in light of the extensive and oftentimes prescriptive requirements, banks may face a range of challenges. For small- and medium-sized banks, the following items may present the major hurdles.

1) Developing robust and accurate systems to measure and report IRRBB.

2) Documenting and modelling key assumptions, such as the behavioural repricing profile of non-maturity deposits (NMD).

3) Embedding IRRBB into wider risk management practices and developing widespread understanding.

4) Quantifying a proportionate risk appetite and defining relevant risk metrics for IRRBB.

5) Tracking the evolution of IRRBB over time and evaluating the impacts to IRRBB of e.g., new business.

6) Defining the most appropriate approach for Pillar 2 assessments.

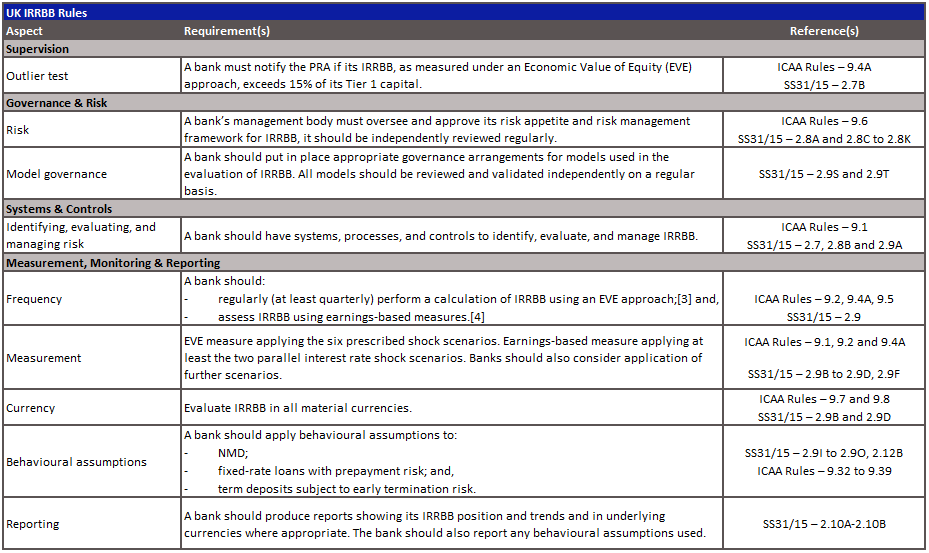

UK IRRBB Rules

The UK IRRBB Rules set out expectations of banks in four principal areas. Below is a high-level, non-exhaustive list of the requirements.

In conjunction with the overall requirements, IRRBB should feature in certain banks’ Pillar 3 disclosures. Such disclosures are consistent with the BCBS’ disclosure framework. These newer disclosure and reporting requirements do not replace return FSA017, which will be reviewed separately and may be amended subject to the outcomes of a PRA consultation.[5]

While Large Institutions have both semi-annual and annual disclosure requirements, Small, Non-complex, and Other Institutions that are also not listed are exempt from such disclosure requirements. [6]

[3] A bank may adopt the SF and apply the associated methodology for calculation of the EVE measure (see Appendix A of the downloadable version).

[4] The frequency for earnings-based measurement is not explicitly defined; however, we would advise this is carried out at least quarterly or at the same interval as EVE calculations.

[5] PS26/20 ‘Capital Requirements Directive V (CRD V)’, para. 9.4.

[6] See, PRA Rulebook: CRR Firms, Disclosure (CRR) Part, articles 433a-433c, 448.

Measuring IRRBB

IRRBB is typically quantified in two distinct but complementary ways.

Economic Value of Equity measures

An EVE approach evaluates the change in the net present value of all cash flows originating from banking book assets, liabilities, and off-balance sheet items resulting from a change in interest rates and typically assuming a run-off balance sheet.

For many small- and medium-sized banks, adoption of the SF offers a clear and straight-forward route for measuring IRRBB under an EVE approach. Where a bank elects to adopt the SF (or subsequently wishes to cease its use) it must notify the PRA.[7] Appendix A of the downloadable version provides a guide for banks on application of the SF.

Alternatively a bank can apply its own measurement methodology provided it is deemed to be adequate.[8]

Earnings-based measures

An earnings-based approach evaluates the change in earnings (usually with a focus on net interest income) over a particular time horizon as a result of movements in interest rates and based on certain balance sheet assumptions (e.g., run-off balance sheet, constant balance sheet, dynamic balance sheet).

At the present time, the PRA has not specified a standard methodology for evaluation of IRRBB using an earnings-based measure. However, it has provided the following parameters, which should be applied as appropriate to a bank’s circumstances, activities and risk profile, and on a proportionate basis.[9]

Assessment period of 3- to 5-years;

Using a bank’s projected volumes and pricing, and the projected path for rates;

Considering any impact to the bank’s cashflows; and,

Evaluating the change in market value of interest rate-sensitive instruments.

[7] ICAA Rules, 9.1C.

[8] If the PRA determines that the bank’s measurement approaches are inadequate then it can require the bank to adopt the SF (SS31/15, 2.9A).

[9] SS31/15, para. 2.9C(i), (ii), (iv), (v).

Interaction with Pillar 2 and Stress Testing

The UK IRRBB Rules identify that, in accordance with ICAA Rules, 3.1, (the Overall Pillar 2 Rule), a bank must evaluate its exposure to IRRBB using both EVE and earnings-based measures. Such an evaluation should be carried out as frequently as required by the bank, but at least annually.

Presently there appears to be some divergence between the UK IRRBB Rules and the PRA’s published approach to setting a firm’s Pillar 2A capital requirement for small- and medium-sized banks (see Statement of Policy ‘The PRA’s methodologies for setting Pillar 2 capital’). Banks should assess the significance of variances between their internal EVE assessments (e.g., via application of the SF) and those obtained via return FSA017. Due consideration should also be given in Pillar 2 assessments to earnings-based measures.

Extending beyond those assessments required under the prescribed interest rate shock scenarios, the PRA expects a bank to apply its own interest rate shock scenarios based on its risk profile as well as historical and hypothetical interest rate stress scenarios, including those that make use of larger or extreme shifts in interest rates.

Banks are also required to conduct regular stress tests, including reverse stress tests, that allow it to identify interest rate scenarios that could significantly threaten its capital and earnings, and reveal any vulnerabilities in its business model and approach to the management of IRRBB.

Credit Spread in the Banking Book

Credit Spread Risk in the Banking Book (CSRBB) is often considered alongside IRRBB and its associated regulations. CSRBB refers to the risk of variations in spreads – associated with any credit-risky asset or liability – which is explained neither by interest rate movements nor idiosyncratic credit factors. Instead, CSRBB refers to the risk of variations in credit and liquidity risk premia.

As part of the UK IRRBB Rules, the PRA expects banks to monitor and assess their CSRBB.[10]

Regulatory guidance on CSRBB is limited and to date the PRA has stated only that it does not intend to prescribe how banks should assess CSRBB.[11] The European Banking Authority’s (EBA) recent IRRBB and CSRBB guidelines (EBA/GL/2022/14) provide more extensive discussion of CSRBB, which banks may take as useful guidance.

When approaching CSRBB, a bank should identify its exposures in a proportionate manner, depending on its complexity and the riskiness of its non-trading book positions. Banks could model their CSRBB oversight and governance frameworks on those embedded for IRRBB and follow the measurement methodologies (EVE and earnings-based) for both assessment and reporting.

Source: EBA/GL/2022/14

[10] ICAA Rules, 9.1A.

[11] PS26/20 ‘Capital Requirements Directive V (CRD V)’, para. 9.42.

How We Can Help

Banks may face a variety of challenges when meeting the extensive and detailed requirements set out in the UK IRRBB Rules (including in relation to CSRBB). At Katalysys, we have a deep understanding of IRRBB from the perspective of regulatory rules, modelling and measurement, and in terms of practical management. We also offer a cloud-based IRRBB measurement and reporting solution – k-ALM® IRRBB.

Our team has supported a range of clients in this area, from those seeking first authorisation to well-established institutions. Whether you need:

a cloud-based IRRBB solution;

support in defining an IRRBB Risk Management Framework including risk appetite;

assistance embedding policies relating to IRRBB;

guidance on modelling of behavioural assumptions, including NMD;

an independent review of your existing IRRBB frameworks, models or processes,

We have the subject matter expertise and technical skills to help.

For more information, please contact:

Josh Nowak

Managing Director, Risk & Regulatory Consulting

T: +44 (0)7587 720988