Stress Testing the Future: A Small- and Medium-sized Banks' Guide to Climate Scenario Analysis

Executive Summary

Climate change presents profound challenges for banks, affecting a range of prudential risks through both physical and transition channels. Regulators now expect firms to embed climate-related financial risks (CRFR) as part of their core risk management processes. The Prudential Regulation Authority’s (PRA) Supervisory Statement 5/25 marks a clear step forward: climate scenario analysis (CSA) is no longer simply encouraged. It must inform strategy, risk appetite, capital and liquidity planning, and even reverse stress testing.

For small- and medium-sized banks, we view the challenge as practical rather than conceptual: banks are already familiar with stress testing, after all. However, the difficulty lies in adapting established methods to longer term horizons, multiple climate scenarios, and the unique uncertainties of climate science.

In this article, we outline our proportionate approach that small- and medium-sized banks can take when approaching CSA:

Why CSA matters – Supervisory expectation, strategic resilience, clearer decision-making.

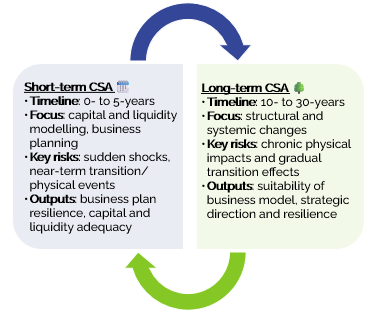

How it works – Short-term scenarios (up to 5-years) test near-term shocks and planning resilience; long-term scenarios (10- to 30-years) explore structural changes and strategic sustainability.

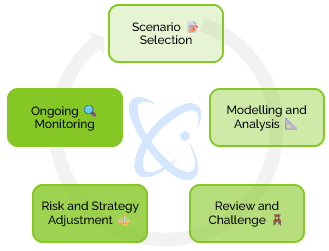

The process – A recurring cycle of scenario selection, modelling and analysis, governance and review, strategic adjustment, and ongoing monitoring.

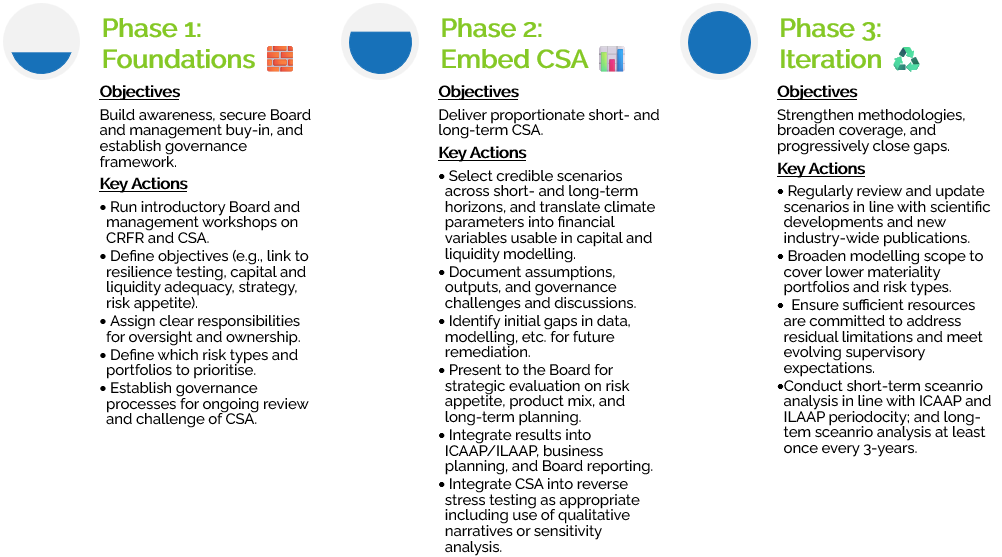

A roadmap – Three phases for firms to consider:

Foundations: build awareness, governance, and scope.

Embed CSA: deliver proportionate short- and long-term analyses, link to Internal Capital Adequacy Assessment Process (ICAAP) and Internal Liquidity Adequacy Assessment Process (ILAAP), and report to the Board.

Iteration: broaden coverage, close gaps, update with evolving data and scientific developments, and ensure adequate resources.

With a clear roadmap, small- and medium-sized banks can meet regulatory demands and use CSA not only to comply, but to steer their strategy for a sustainable future.

At Katalysys, we support firms at each stage: from Board workshops and scenario design, through capital and liquidity modelling with our k-alm® toolkit, to documentation, reporting, and embedding CSA into the wider CRFR framework.

Our approach is proportionate, credible, and designed to give Management teams and Boards clarity, confidence, and readiness to not only meet supervisory guidelines but also align these seamlessly within its broader risk management arrangements.

Background

Climate change, defined as long-term shifts in weather patterns and temperatures, has far-reaching consequences beyond environmental and societal effects. For banks, it directly impacts the risks they are exposed to. Understanding these implications is crucial, as it allows them to make better strategic decisions, remain competitive, and evolve their risk frameworks. A key part of this process involves climate scenario analysis (CSA).

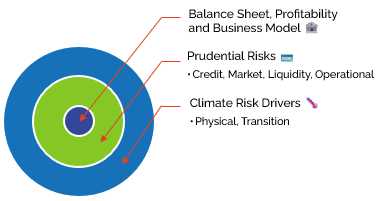

Climate risk drivers transmit through traditional prudential risk categories, ultimately affecting the bank’s balance sheet and business model.

Prudential Context

Supervisory Statement 3/19 (SS3/19), introduced by the PRA in 2019, set the UK’s first supervisory expectations on climate-related risks. While firms should have fully embedded their approaches to managing climate-related financial risks by the end of 2021, progress was uneven – the PRA’s 2020 Dear CEO Letter highlighted some key gaps as well as several implementation challenges.

More recently, the PRA published Consultation Paper 10/25, as part of which it proposed a range of updates to supervisory expectations on CRFR – these were finalised through Policy Statement 25/25 and the accompanying Supervisory Statement 5/25 'Enhancing banks’ and insurers’ approaches to managing climate-related risks' (SS5/25): read our article for the key highlights and download our guide for details of the 41 expectations that non-systemic banks need to consider proportionately.

SS5/25 is applicable to all UK banks and replaces SS3/19 from its publication date, 3 December 2025.

The new expectations mark a step-change from SS3/19, enhancing requirements in areas such as governance, risk management, data, disclosures, and CSA. The heightened emphasis on CSA is designed to ensure that firms incorporate climate-related considerations into their strategic decision-making, risk appetite setting, and the management of both capital and liquidity.

Under SS5/25, CSA is no longer simply encouraged: it becomes a clear supervisory expectation. Any fallback or alternative approach in the absence of CSA will likely be subject to challenge and would require strong justification and rationale.

Why Implement CSA Now?

- Clear direction of travel in supervisory expectations

- Enhance capital and liquidity planning

- Ensure strategic resilience

Existing Literature

A quick look at the financial literature on climate change reveals a substantial and growing body of research. This is understandable given its continuous evolution, global relevance, and the many inherent uncertainties (e.g., the range of possible paths for our climate, the transition to a greener economy, unknown natural events, and governmental responses, all of which lead back to financial risks for the banking sector).

Stakeholders from across the world have delved deep into the various aspects of how CRFR affects banks, exploring risk management practices, governance, data, credit and operational risks, and disclosures. The research on CSA has also proliferated as central banks, regulators, and institutions work to define its objectives, methodologies, and application.

For some context, a staff working paper from the Basel Committee on Banking Supervision in late 2023 explored 190 papers published across academic journals and by industry and regulatory bodies (as well as some central banks) since 2010, with a notable focus on credit and market risks, and the supply of credit. We can be sure that the number of publications is far higher when considering more recent research or broadening the scope to cover aspects such as CSA.

The sheer quantity of information, while incredibly valuable, has made it complicated for banks to digest and interpret. Banks face challenges in determining which research to prioritise, how to use the selected information, in reconciling contradictory findings, and in assessing whether approaches may soon be superseded by new evidence.

These are valid questions that must be addressed for further progress to be made.

What is Climate Scenario Analysis?

Scenario analysis, or stress testing (for the purposes of this paper, the terms scenario analysis and stress testing are used interchangeably), is a useful tool both for the quantification and understanding of risk as well as for strategic planning and decision making. It allows a bank to analyse the financial impacts of pre-determined scenarios on its balance sheet, capital, liquidity, risk positions, profitability, and franchise both quantitatively and qualitatively.

CSA is a sub-type of stress testing that can be used to assess the robustness of business models and strategic plans against a spectrum of plausible climate pathways, and to evaluate the implications of climate-related risk drivers for a bank’s overall risk profile.

Ultimately, CSA is fundamentally like a traditional stress test used by banks in existing risk management processes such as the ICAAP; however, the scenarios and assumptions are different. Traditional stress tests focus largely on economic recessions and pre-existing operational risks, whereas CSA is geared toward understanding the implications of risks linked to the low-carbon transition and physical climate events.

Climate scenario analysis is a continuous cycle, requiring design, modelling, governance review, strategic adjustment, and ongoing monitoring.

There is no shortage of climate scenarios. While the Network for Greening the Financial System (NGFS) is an often-cited source, the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA) also supply a mixture of scientific climate and energy transition projections.

Furthermore, some of these inputs are translated or tailored by other bodies, such as individual central banks – e.g., by the Bank of England in its 2021 Climate Biennial Exploratory Scenario (CBES), or by the European Central Bank in the 2022 Climate Risk Stress Test – and other intermediary bodies like the United Nations Environment Programme Finance Initiative (UNEP FI) or the National Institute of Economic and Social Research (NIESR).

This increases the challenges associated with scenario selection and points to the need to explore multiple scenarios, in a similar way to traditional stress tests.

Challenges Faced by Banks

Despite being well-versed with stress testing and scenario analyses – these exercises in one form or another are being carried out on a continuous basis for the ICAAP, ILAAP, Recovery Plan, Solvent Exit Analysis, and more – banks face some specific challenges in relation to CSA.

These hurdles are likely to be more practical than conceptual in nature, which may make them more straightforward to overcome, albeit a detailed approach is required.

| Issue | Challenge |

|---|---|

| Short- and Long-term Horizons | How to apply a long-term (30–50 year) climate scenario to a short-term (3-year) business plan and capital planning horizon? |

| Integrating Scenarios | How to incorporate long-term climate impacts into short-term stress testing exercises when risk crystallisation may occur over decades? |

| Scenario Selection | How to select relevant climate scenarios and translate scientific variables (eg temperature pathways) into macroeconomic drivers suitable for modelling? |

| Governance and Outcomes | How to interpret CSA outputs, ensure effective Board challenge, and integrate results into strategy, risk appetite, ICAAP and related governance processes? |

The Varying Flavours of CSA

Prudential guidelines on CSA draw on the importance of sub-types of CSA. These elements are primarily focused on the purpose of the exercise (say, strategic planning versus resilience analysis) but might more simply be differentiated by the time-horizon considered.

Short- and long-term CSA are mutually reinforcing and should both be integrated.

Short-term scenarios typically span periods of up to 5-years and are primarily used for applications like capital and liquidity modelling and business planning. They can be ideal for evaluating risks that might emerge within a standard planning cycle or for testing a bank’s resilience to sudden, unexpected physical shocks. However, the limited timeframe can make them less effective at capturing broader, system-level impacts that unfold over longer horizons.

In contrast, the long-term scenarios extend over several decades. They are designed to explore structural shifts in the wider economy and to test the resilience of a firm’s strategy and business model against these changes. But the extended horizons introduce considerable uncertainty into economic projections, and historical data offers little reliable guidance for assessing the scale or timing of unprecedented risks like those related to climate change.

These differing approaches within CSA serve distinct yet complementary objectives and are crucial for comprehensive risk management and strategic planning. In practice, firms will benefit from applying both approaches owing to the specific focus of each variant.

Laying a Foundation for CSA

“The secret of getting ahead is getting started,” as the saying goes. We therefore look to lay a foundation to help small- and medium-sized banks commence their CSA journey from an informed starting point, that aligns with proposed regulatory guidance.

| Aspect of CSA | Recommendation |

|---|---|

| Types 🗂️ | • Conduct both short- and long-term CSA – short-term modelling aligned to the business planning period, and long-term analysis spanning decades. |

| Scenarios 🧭 |

• Adopt recognised scenarios from credible bodies such as NGFS. • For longer-term analysis, draw on prevailing NGFS scenarios (Phase V), covering orderly and disorderly transition, hot-house world (physical-focused), and too-little-too-late (combined) pathways. • For short-term analysis, consider NGFS near-term scenarios (May 2025) covering transition, physical, and combined pathways. • Include a scenario consistent with relevant climate targets. • Clearly justify scenario selection for each specific use case. |

| Modelling approach ⚙️ |

• Short-term: based on the Board-approved business plan and associated planning period. • Long-term: based on a static balance sheet assumption. |

| Parameters 📈 |

• Identify material risk areas (credit, market, operational) and map them to relevant climate parameters using recognised datasets (eg NGFS Phase V). • Ensure calibrations are proportionate, fully documented, and subject to governance and challenge. |

| Outcomes 🎯 |

• Document CSA progress within the ICAAP and ILAAP and include a summary of short- and long-term results. • Extend reverse stress testing to encompass CRFR where appropriate, including qualitative or sensitivity analysis. • Present scenarios, limitations, and full outputs to the Board and relevant risk oversight committees, ensuring any required adjustments to risk appetite, CRFR management, or strategy are identified. |

| Future developments ⏭️ |

• Continue to develop the CSA framework through periodic re-evaluation, incorporating latest guidance and reassessing data quality, model limitations, and emerging themes. • Progressively address gaps in the CRFR framework to enhance CSA capability. • Ensure appropriate Board-level oversight and resource allocation to support ongoing CSA development. |

A Three-phased Roadmap for Small- and Medium-sized Banks

The roadmap is designed to be proportionate for small and medium-sized firms, while aligning with PRA guidance in SS5/25.

How We Can Help

At Katalysys, we specialise in bank stress testing, helping firms seamlessly integrate CRFR into their existing risk management frameworks. We work in partnership with small- and medium-sized banks to design and deliver proportionate CSA programmes that cover:

Facilitating Board and Management workshops on CRFR and CSA.

Setting objectives and selecting appropriate scenarios.

Capital and liquidity stress modelling using our k-alm® toolkit.

Producing clear and comprehensive documentation of the CSA process and results.

Supporting management teams in presenting findings to the Board.

Addressing gaps in existing CSA frameworks.

Embedding CSA within the broader CRFR framework.

Strengthening ICAAP and ILAAP coverage in a proportionate and credible way.

Whether you are building your CSA capability from the ground up or refining a more established process, we provide the technical expertise and strategic insight needed to deliver clarity, confidence and credible outcomes.

For more information, please contact:

Josh Nowak

Managing Dir

ector, Risk & Regulatory Consulting

T: +44 (0)7587 720 988

Ravi Patel

Vice President, Risk & Regulatory Consulting

T: +44 (0)7387 972 729