UK Basel 3.1: Credit risk standardised approach – off-balance sheet items

On 12 September 2024, the Prudential Regulation Authority (PRA) published the second part of its near-final rules on the implementation of Basel 3.1 standards through Policy Statement 9/24 (PS9/24) which offers feedback on the responses received on Consultation Paper 16/22 (CP16/22) published on 30 November 2022.

PS9/24 covers inter alia the near-final rules on credit risk, disclosures, and reporting as well as minor clarifications and corrections to the previous near-final rules published within PS17/23. The implementation date for Basel 3.1 standards has now been postponed to 1 January 2027.

A brief summary of the changes to determine the exposure value of off-balance sheet items under the credit risk standardised approach is provided below.

Key changes to determine the exposure value of off-balance sheet items, include:

Off-balance sheet items are categorised into:

- issued off-balance sheet items where a firm has underwritten an obligation to a third-party and stands behind the risk; and

- commitments to extend credit, purchase assets, or issue off-balance sheet items at a future date.

Conversion factor (CF) increased from 0% to 10% for unconditionally cancellable undrawn commitments.

Commitments, where drawdowns are certain, will attract a CF of 100%.

Other transaction-related contingent items will attract a CF of 20%.

‘Other commitments,’ aside from UK residential mortgage commitments will attract a CF of 40%.

Other issued off-balance sheet items (including UK residential mortgage commitments that are not subject to a CF of 10% (unconditionally cancellable) or 100% (drawdown is certain)) shall receive a CF of 50%.

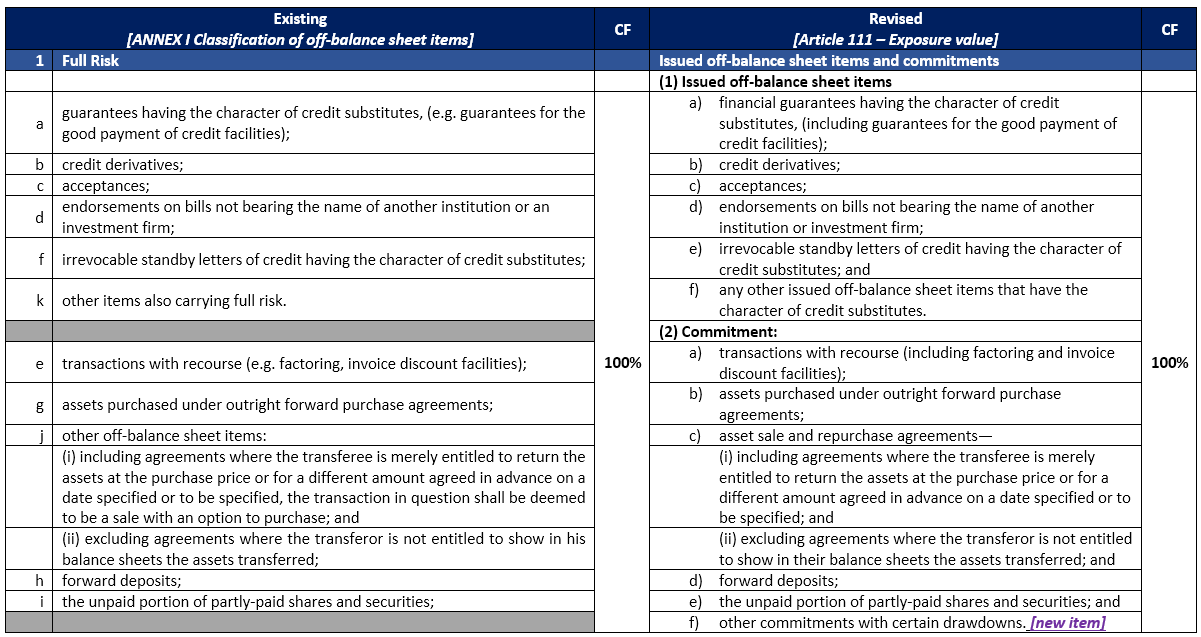

A summary of the revised classifications and applicable CFs is given below:

Existing and revised CFs:

Items in the ‘Existing’ column are re-arranged to align them with the revised rules for comparison purposes.

Colour coding and pointers have been added to the table to highlight the change in the risk category.

How We Can Help

Banks may face a variety of challenges when preparing for Basel 3.1. At Katalysys, we have a deep understanding of prudential regulatory requirements both from the perspective of rules and practical implementation. Our team is already supporting a range of clients in this area, and includes:

Workshops or training to cover new requirements.

Gap and impact analyses.

Guidance on implementing industry best-practice in relation to the Basel 3.1 standards.

Documenting or updating assumptions and interpretations in regulatory reporting.

Preparation of regulatory reporting policies and procedure notes.

Validation of the system outputs and calculations.

Review of regulatory returns, including post-implementation of Basel 3.1 changes.

For more information, please contact:

Josh Nowak

Managing Director, Risk & Regulatory Consulting

T: +44 (0)7587 720 988

Manish Patidar

Director, Regulatory Consulting

T: +44 (0)7766 001 643