PRA’s 2024 ICAAP Stress Test Scenarios for Non-Systemic Banks

Overview

On 27 June 2024, the Bank of England (“BoE”) and Prudential Regulation Authority (“PRA”) published the ICAAP Scenarios for non-systemic [1] UK banks (the “2024 ICAAP Scenarios”), which are the supply shock scenario and the demand shock scenario. These scenarios can be used as a template and benchmark in developing the bank’s own stress testing scenarios for the Internal Capital Adequacy Assessment Process (ICAAP) exercise and can also be used in developing the market-wide scenarios for the Internal Liquidity Adequacy Assessment Process (ILAAP) exercise.

The 2024 ICAAP Scenarios are the same as defined in the PRA’s 2024 desk-based stress test (the “2024 DBST”) applicable to the major UK banks and building societies, which represent c.75% of lending to the UK economy. However, the scenario variable in the 2024 ICAAP Scenarios are an abridged version of those defined in the 2024 DBST.

The 2024 DBST is a critical exercise aimed at assessing the resilience of the UK banking system under severe but plausible economic conditions, allowing the BoE and the PRA to evaluate the overall resilience of the UK banking system, ensuring that shocks can be absorbed without risk of severe contagion and disorderly exits.

[1] Banks that are not part of concurrent stress testing

2024 ICAAP Stress Scenarios

The PRA’s ICAAP scenarios have been designed with the aim of stressing key economic variables to severe but plausible levels, informed by: historical experiences, the BoE’s view of current risks, and additional factors aligned to the FPC’s latest risk assessment, ensuring comprehensive coverage of all important aspects.

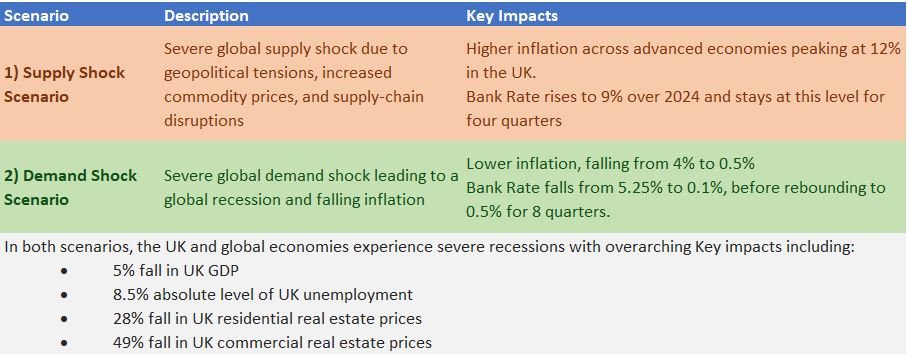

For the 2024 ICAAP Scenarios, two distinct scenarios have been formulated: a supply shock scenario, and a demand shock scenario. The primary difference between these scenarios lies in their divergent paths for inflation and interest rates, given the growing uncertainty currently present in global markets.

These stress tests span a 5-year period, commencing at the end of December 2023, with peak impacts anticipated in the fourth quarter of 2024.

How Do the Stress Scenarios Compare to Recent Benchmarks?

To gauge the severity of stress scenrios, it is helpful to compare against other recent examples and historical experiences. In this case, it is logical to evaluate the 2024 ICAAP Scenarios parameters against the previous BoE 2022/23 scenario (“ACS”) and observations during the 2008 Global Financial Crisis (“GFC”). The following diagrams illustrate these comparisons.

As can be seen, the BoE has retained the severity of a range of assumptions when compared to the last set of scenarios in 2022, which are appropriately adjusted in light of changes in the economic environment and the paths of macro variables since that time. For example, inflation is now seen as re-surging to high levels – but to a lesser extent than observed in the previous set of scenarios, or dwindling to de minimis levels; similarly, Bank Rate is accordingly adjusted taking account of both the current rate environment and these stressed inflationary paths, i.e., spiking to 9% in a resurgent inflationary crisis, or dropping rapidly towards the effective lower bound in a disinflationary outcome.

How Can Small- and Medium-sized Banks Use the 2024 ICAAP Scenario?

The evolution in macro parameters as part of the 2024 ICAAP Scenarios will be much welcomed by banks looking for a more current, up-to-date and realistic market-wide stress benchmark for use in internal stress testing, including as part of the Internal Capital and Internal Liquidity Adequacy Assessment processes (“ICAAP” and “ILAAP”).

Banks should carefully review these scenarios and thoroughly assess their relevance based on the bank’s financial and risk positions and considering its vulnerabilities. UK Subsidiaries of foreign owned banks may also benefit from use of elements from the wider 2024 DBST scenarios, which include additional stress factors relating to other jurisdictions including Europe, USA and China, given the differing type of business models and geographical presence. To begin, banks may conduct board/management workshops to review these scenarios and determine how they can be applied within their own stress testing exercises - including the key assumptions to be adopted.

Banks will benefit from undertaking modelling of both 2024 ICAAP Scenarios to better understand their financial resilience under these outcomes, given the current uncertain outlook for economies globally. At the very least, banks should identify the most appropriate of the two 2024 ICAAP Scenarios and adopt that as their benchmark for the market-wide stress test, aside another scenario have more acute relevance to the firm, to produce stress testing results.

How We Can Help

At Katalysys, we specialise in assisting banks facilitate comprehensive and fit-for-purpose ICAAP and ILAAP exercises, including support with stress testing. This includes facilitating board and management stress testing workshops, selecting stress scenarios in consultation with board/management, identifying the key stress variables and levers based on the bank’s specific business model, developing capital and liquidity stress models, identifying management actions and documenting the overall outcome of the stress testing exercise.

We have a team of dedicated specialists focussed on demystifying the stress testing process and ensuring a thorough assessment while ensuring clear understanding among key stakeholders.

Recognising that each bank's business model, core products, and key risks are unique, we collaborate closely with our clients to ensure their stress testing exercises are tailored to their specific needs. We also support firms in ensuring that their stress testing approaches, methodologies and models are fit-for-purpose, proportionate to the size and scale of the firm, and reflective of regulatory guidance and industry best practice.

We have the knowledge and technical skills to help.

For more information, please contact:

Josh Nowak

Managing Director, Risk & Regulatory Consulting

T: +44 (0)7587 720988

Ravi Patel

Vice President, Risk & Regulatory Consulting

T: +44 (0)7387 972729