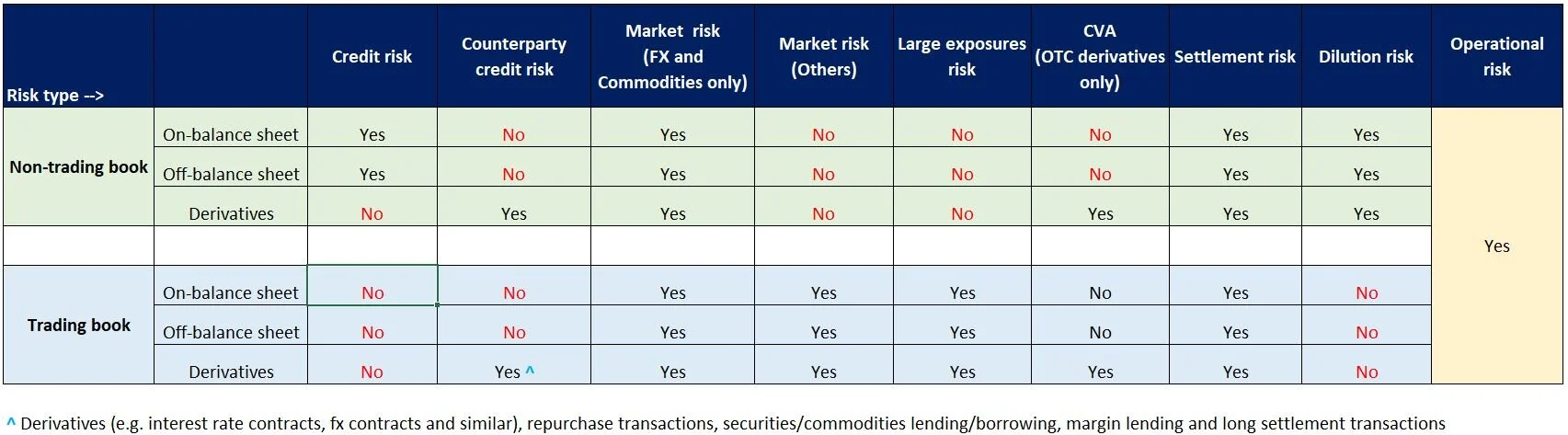

CRR2 - Own funds requirement by exposure type

A common question we are asked is the basis on which own funds requirement has to be calculated for the various types of exposures on the non-trading and trading book. The below table provides a high-level summary of this mapping of the exposure types to the risk assessment to be used. This is based on Article 92 of the CRR.

The bank’s trading book (on- and off-balance sheet) qualifies for small trading book derogation if it meets the following conditions, as evaluated at the end of each month [Article 94]:-

trading book size is less than 5% of total assets; and

is less than GBP 44 million.

Under the small trading book derogation, the bank can calculate its own funds requirement for the small trading book based on the following:-

1) For interest rate contracts, equities derivatives and credit derivatives - no market risk own fund requirement needs to be calculated

2) For other trading book exposures (other than FX and commodities; and those not listed in (1) above) - the market risk own funds requirement can be “replaced” by Credit or Counterparty Credit risk own funds requirement (e.g. for traded debt instruments in the trading book).

Note: For FX and commodities, even with small trading book derogation, market risk own funds requirement should still be calculated (in addition to credit/counterparty credit risk assessment).

The size of the trading book (on- and off-balance sheet) will be the sum of the market value of all trading book positions, excluding foreign exchange and commodities and credit derivatives that act as internal hedges against non-trading book exposures. In the event market value is not available, banks can use the fair value of the position.

Implementation date: The above requirements came into effect on 1 January 2022.