Dear CEO Letter - Non-systemic firms’ recovery planning thematic review - 2024

Overview

On the 15th May 2024, The Prudential Regulation Authority (“PRA”) published the outcomes of a thematic review it conducted on the recovery planning capabilities of approximately 70 non-systemic UK banks and building societies. The following summary aims to provide insights on key areas of improvements and actions for non-systemic UK banks.

Why is Recovery Planning Important?

Recovery planning is crucial for financial institutions in order for them to prepare for and manage periods of financial stress. Effective recovery plans help firms understand their vulnerabilities, test their capabilities, and set out recovery actions for use during crises. A recovery plan should assist the firm in promptly becoming aware of a crisis and efficiently responding to it, thus promoting financial resilience and minimising the risks for damage to the financial sector.

What are the Implications of the PRA’s Review?

The PRA’s review spotlights critical areas for banks to address, while providing examples of effective practices and mapping out the steps firms should take to elevate their recovery planning processes.

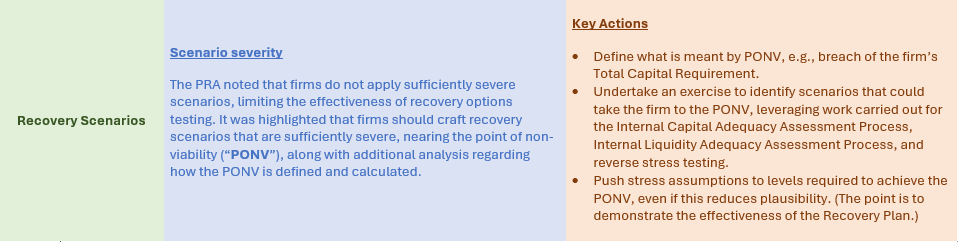

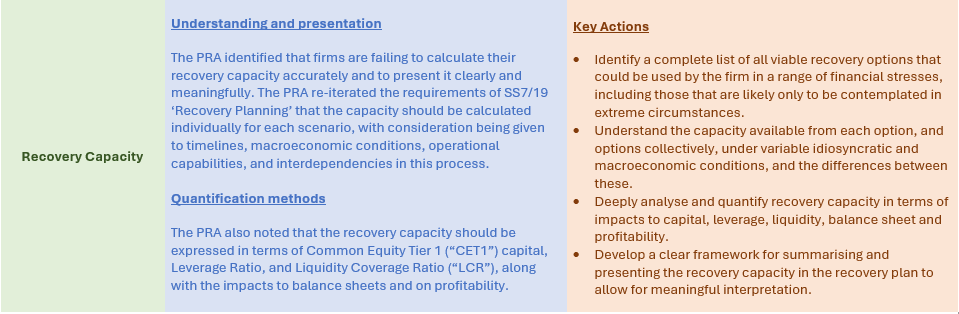

By emphasising key areas for improvement – such as the development of recovery scenarios and the precise calculation of recovery capacity – the PRA hopes that firms can be better prepared for future challenges.

Key Areas for Improvement and Actions for Firms

A summary is outlined below:

In addition to using point-in-time recovery indicators, banks can also consider using forward looking indicators and movement type indicators, which could highlight impending stress.

Next Steps

The PRA’s thematic review highlights the importance of robust recovery planning. By addressing the highlighted areas for improvement and adopting effective practices, firms can enhance their resilience and ability to manage financial stress.

Over the coming months, the PRA plans to engage with industry participants to discuss the findings of its thematic review including the June 2024 CEOs conference.

In addition and connected with recovery planning more widely, as detailed in our earlier article, firms must soon address the requirements of SS2/24 ‘Solvent exit planning for non-systemic banks and building societies.’ Work undertaken by banks in the purview of recovery planning may serve a dual purpose and form a useful foundation upon which a bank can build during planning and implementation of its solvent exit analysis.

How We Can Help

At Katalysys, we specialize in assisting banks with comprehensive recovery planning: from facilitating a recovery planning exercise to recovery plan modelling; and from board or management workshops to supporting in fire drill exercises.

Recognising that each bank's business model, core products, and key risks are unique, we collaborate closely with our clients to ensure their recovery planning exercises are tailored to the needs of the firm. We also support firms in ensuring that their recovery plans are fit-for-purpose, proportionate to the size and scale of the firm, and reflective of regulatory guidance and industry best practice.

We have the knowledge and technical skills to help.

For more information, please contact:

Josh Nowak

Managing Director, Risk & Regulatory Consulting

T: +44 (0)7587 720988

Ravi Patel

Vice President, Risk & Regulatory Consulting

T: +44 (0)7387 972729